tax loss harvesting rules

You wont find any specific reference to tax-loss harvesting in the 45000 words the IRS devotes to investment income and expenses in. You can only do tax-loss harvesting in your taxable brokerage accounts and not in 401ks or IRAs.

Using Tax Loss Harvesting To Turn Capital Losses Into Tax Breaks M1

See What Funds In Your Portfolio Could Be Tax-Loss Harvest Opportunities.

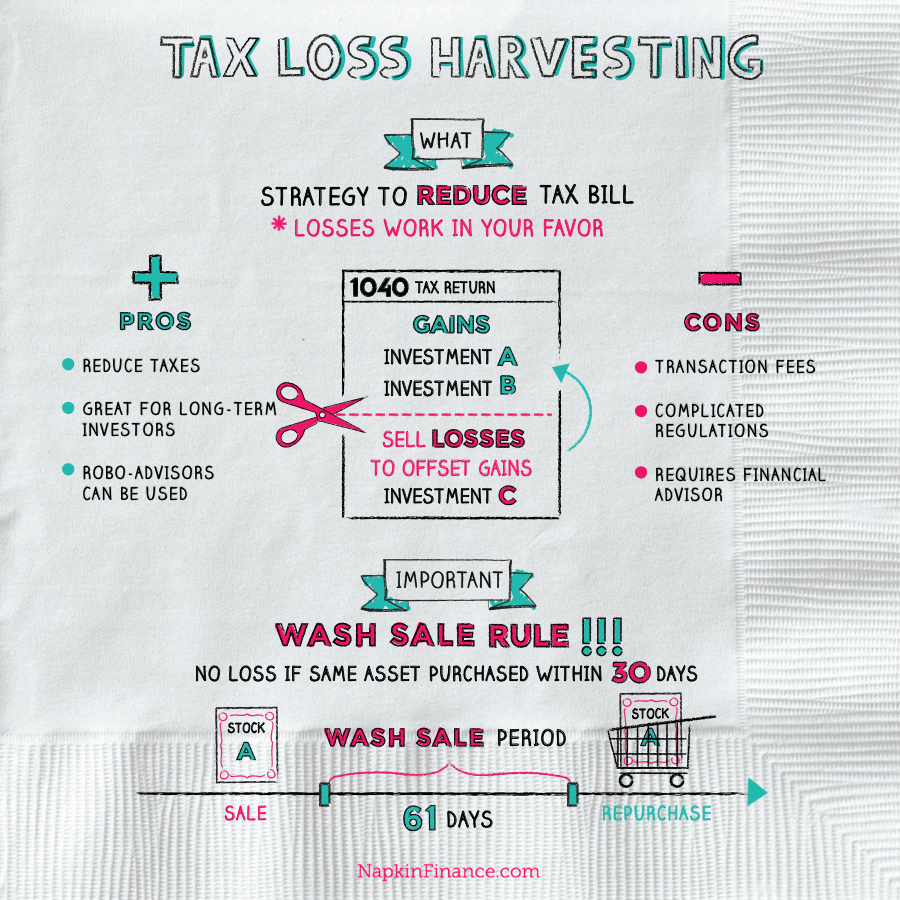

. The basic concept of the wash-sale rule is relatively straightforward its purpose is to limit someone from Tax Loss Harvesting TLH by just selling an investment for a tax. There are some important rules to keep in mind with tax-loss harvesting. Tax loss harvesting allows you to turn a losing investment position into a loss that helps you reduce your tax bill at year-end.

Parametric offers easy-to-understand transition analyses. Your investments need to be in a taxable investment account. Tax-Loss Harvesting Rules 1.

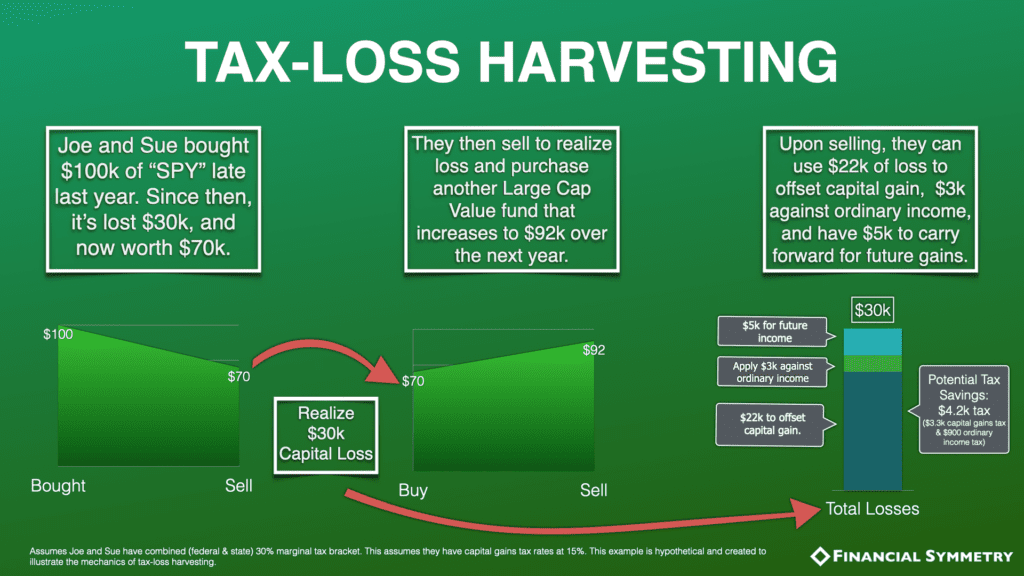

Tax loss harvesting can be a great strategy to lower your tax bill. Tax-loss harvesting is the process of writing off the losses on your investments in order to claim a tax deduction against your ordinary income. And specifically with tax loss harvesting strategies theyve proven to outperform through tax alpha.

Once losses exceed gains you can use the excess to decrease your regular income by up to 3000 per year. Investors can offset up to 3000 per year and losses can be kept in. Tax-loss harvesting isnt useful in retirement accounts such as a 401k or an IRA because you cant deduct the.

Explaining tax loss harvesting rules for income taxpayers Vinit Khandare CEO Founder at MyFundBazaar said Investing in equity funds an investor is known to make. Ad Upload Your Portfolio In Tax Evaluator And See Funds To Tax-Loss Harvest. What is Tax Loss Harvesting.

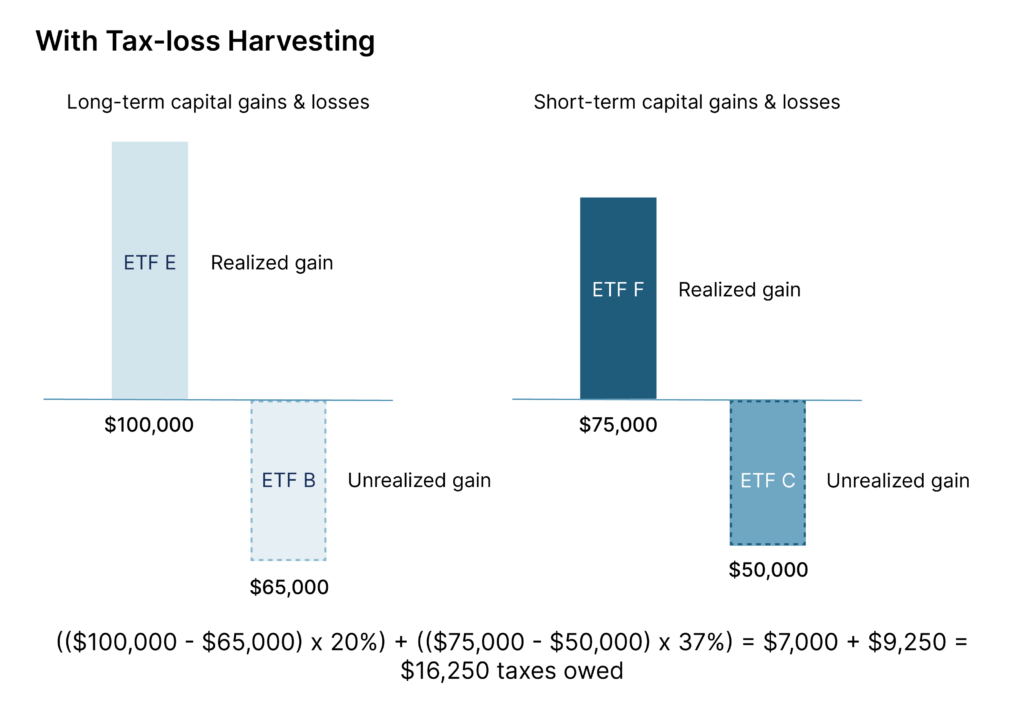

Deciding When Tax-Loss Harvesting Is A Good Idea Deducting Losses Against Capital Gains Vs Ordinary Income Tax Deferral Vs Tax Arbitrage. Tax-loss harvesting is a strategy of taking investment losses to offset taxable gains andor regular income. Ad Upload Your Portfolio In Tax Evaluator And See Funds To Tax-Loss Harvest.

As with any tax-related topic there are rules and limitations. Some investment accounts like your 401 k 403 b or. See What Funds In Your Portfolio Could Be Tax-Loss Harvest Opportunities.

Executive Summary Step 1. This is your one stop shop. To claim a loss on your current.

Ad Find Tax Loss Harvesting Rules. To do it you simply. Tax-loss harvesting rules to know.

Capital Gains Tax-Loss Harvesting Rules Annual Limit to Harvesting Tax Losses. One of the most powerful benefits of tax-loss harvesting stems from the fact that after offsetting other capital gains the first 3000. But it comes with one big restriction.

You cant buy the same. In general tax losses can offset any capital gains that you have. Taking long-term advantage of this tax tool.

Ad Help your clients reduce tax risk while maintaining market exposure. So the real direct indexing tax loss harvesting strategies seek 1 to 2. Ad Download this must-read guide about retirement income from Fisher Investments.

When clients are in loss positions theyre always interested. Financial Planning is complicated let us simplify it for you. You have to wait 30 days to repurchase an investment you sold for a loss if.

Tax Loss Harvesting Opportunity For Fiscal Year Fy 2021 22 Z Connect By Zerodha Z Connect By Zerodha

How To Cut Your Tax Bill With Tax Loss Harvesting Charles Schwab

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting A Silver Lining In Bear Markets Financial Symmetry Inc

Tax Loss Harvesting Everything You Should Know

Taxlossharvesting Napkin Finance

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Is It Possible To Do Tax Loss Harvesting For Crypto Losses In Germany R Germany

How To Use Tax Loss Harvesting To Boost Your Portfolio

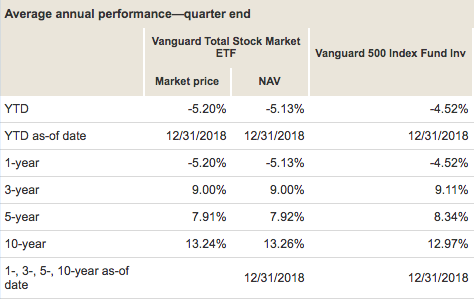

Tax Loss Harvesting With Vanguard A Step By Step Guide Physician On Fire

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Selling For Australian Investors

Tax Loss Harvesting For Uhnw Investors Bernstein

Tax Loss Harvesting And Tax Gain Harvesting Step By Step

Quiz Worksheet Tax Loss Harvesting Study Com

Financial Planning Using Your Tax Return Morgan Stanley

When Not To Use Tax Loss Harvesting During Market Downturns

Tax Harvesting Can Save Up To 10 000 In Ltcg Taxes Every Year Kuvera